You may qualify

for up to $32,200!

THE DEADLINE TO FILE IS APPROACHING. DON'T MISS THIS OPPORTUNITY!

You may qualify

for up to $32,200!

THE DEADLINE TO FILE IS APPROACHING. DON'T MISS THIS OPPORTUNITY!

If you are a...

Self-employed Business Owner, a 1099 Subcontractor, or a Family-Centered Small Business

YOU MAY BE ELIGIBLE

What is SETC?

The Self-Employment Tax Credit (SETC) has been crafted specifically to offer crucial assistance to self-employed individuals during the ongoing COVID-19 pandemic. This tax credit recognizes the distinct challenges that self-employed professionals encounter, particularly when dealing with issues like illness, caregiving commitments, quarantine, and other related circumstances. For eligible individuals, the SETC serves as a valuable lifeline, helping bridge financial gaps caused by unexpected disruptions. Discover how this credit can provide you with much-needed financial relief during these challenging times.

The Self-Employment Tax Credit (SETC) has been crafted specifically to offer crucial assistance to self-employed individuals during the ongoing COVID-19 pandemic. This tax credit recognizes the distinct challenges that self-employed professionals encounter, particularly when dealing with issues like illness, caregiving commitments, quarantine, and other related circumstances. For eligible individuals, the SETC serves as a valuable lifeline, helping bridge financial gaps caused by unexpected disruptions. Discover how this credit can provide you with much-needed financial relief during these challenging times.

Qualification Requirements

DO YOU MEET THE MINIMUM REQUIREMENTS?

Self-Employed Status:

If you were self-employed during 2020 and/or 2021, you might be eligible for the SETC. This encompasses individual proprietors managing businesses with staff, 1099 subcontractors, and single-member LLCs. Filing a “Schedule C” with your federal tax returns for these years indicates you are potentially on the path to qualification.

Individuals with small side hustles, such as Uber, Lyft, Instacart, etc as well as network marketers fall under this criteria as well.

COVID Impacts:

If you faced COVID, had symptoms resembling COVID, were required to quarantine, underwent testing, or took care of a family member impacted by the virus, the SETC might offer you financial support.

Important Notice:

Sub S or True S Corps / C Corps do not qualify for the SETC. This distinct tax credit is solely accessible to business owners who submitted a “Schedule C” or a Partnership (1065) with their federal tax returns for the years 2020 and/or 2021.

Qualification Requirements

DO YOU MEET THE MINIMUM REQUIREMENTS?

Self-Employed Status:

If you were self-employed during 2020 and/or 2021, you might be eligible for the SETC. This encompasses individual proprietors managing businesses with staff, 1099 subcontractors, and single-member LLCs. Filing a “Schedule C” with your federal tax returns for these years indicates you are potentially on the path to qualification.

Individuals with small side hustles, such as Uber, Lyft, Instacart, etc as well as network marketers fall under this criteria as well.

COVID Impacts:

If you faced COVID, had symptoms resembling COVID, were required to quarantine, underwent testing, or took care of a family member impacted by the virus, the SETC might offer you financial support.

Important Notice:

Sub S or True S Corps / C Corps do not qualify for the SETC. This distinct tax credit is solely accessible to business owners who submitted a “Schedule C” or a Partnership (1065) with their federal tax returns for the years 2020 and/or 2021.

ALMOST EVERYBODY THAT HAD SCHEDULE C INCOME QUALIFIES TO SOME EXTENT.

Get Started With Your Application TODAY!

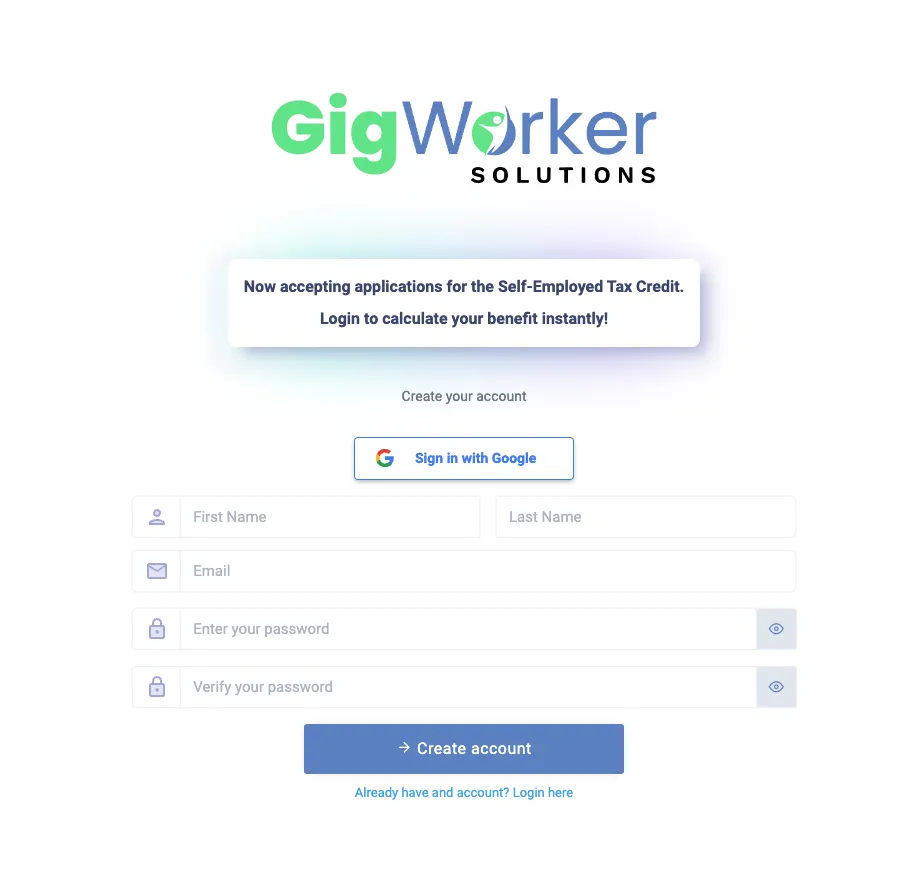

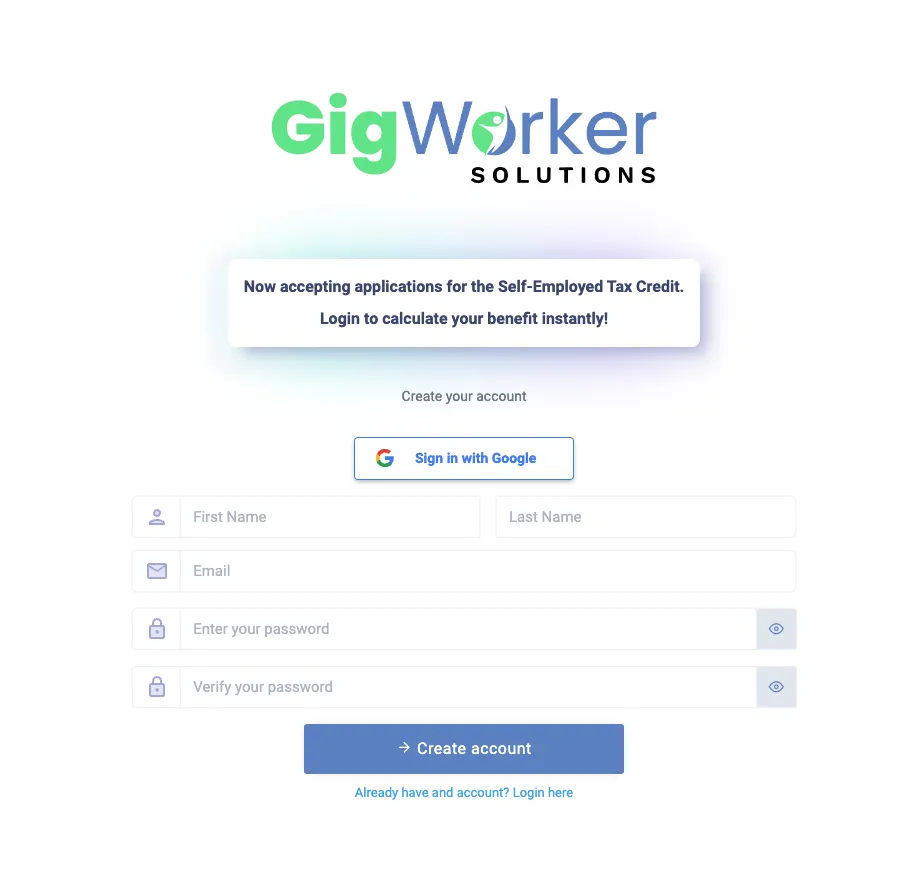

Create a FREE Account

Click the button below and create an account with GigWorker to calculate your refund. (Entire process is FREE and takes 5 min or less)

Create a FREE Account

Click the button below and create an account with GigWorker to calculate your refund. (Entire process is FREE and takes 5 min or less)

Simply enter any disruptions to your business due to COVID-19 during 2020 and/or 2021.

If your business encountered disruptions related to COVID, you might be eligible for the SETC. This covers scenarios such as illness, symptoms, quarantine, testing, and caregiving duties. Additionally, if you had to remain at home due to the closure of your child’s school or daycare, you may also qualify.

Simply enter any disruptions to your business due to COVID-19 during 2020 and/or 2021.

If your business encountered disruptions related to COVID, you might be eligible for the SETC. This covers scenarios such as illness, symptoms, quarantine, testing, and caregiving duties. Additionally, if you had to remain at home due to the closure of your child’s school or daycare, you may also qualify.

Simply enter any disruptions to your business due to COVID-19 during 2020 and/or 2021.

If your business encountered disruptions related to COVID, you might be eligible for the SETC. This covers scenarios such as illness, symptoms, quarantine, testing, and caregiving duties. Additionally, if you had to remain at home due to the closure of your child’s school or daycare, you may also qualify.

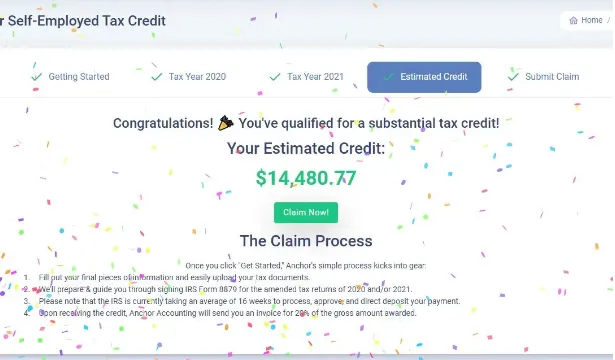

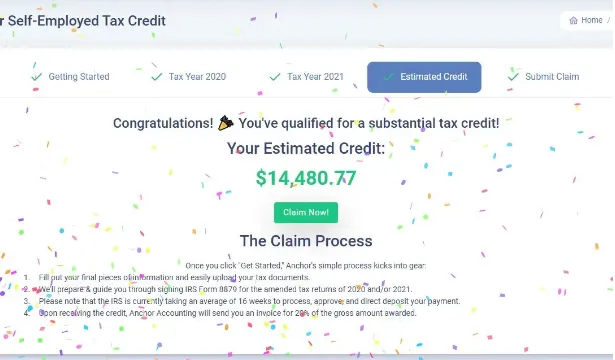

Calculate Your Refund

Discover how much you qualify for by entering your information into our calculator. You may be eligible to recover up to $32,220 in tax credits from 2020 and 2021!

Calculate Your Refund

Discover how much you qualify for by entering your information into our calculator. You may be eligible to recover up to $32,220 in tax credits from 2020 and 2021!

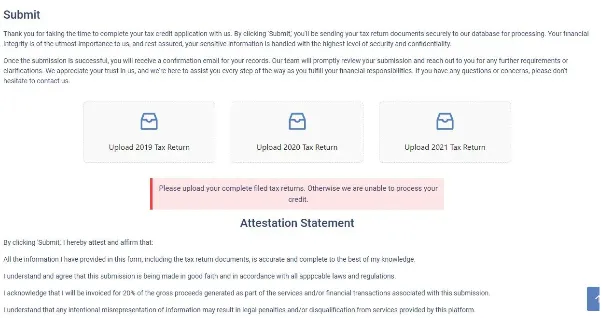

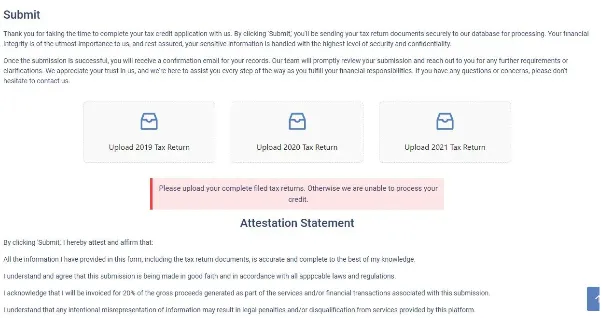

Submit Your Tax Returns, and We Will Do the Rest.

Our team of tax professionals will review your application and submit it to the IRS on your behalf. If you qualify, you'll receive your tax credit in the form of a refund or a reduction in your tax liability. Either way, YOU WON'T PAY A DIME.

Submit Your Tax Returns, and We Will Do the Rest.

Our team of tax professionals will review your application and submit it to the IRS on your behalf. If you qualify, you'll receive your tax credit in the form of a refund or a reduction in your tax liability. Either way, YOU WON'T PAY A DIME.

Frequently Asked Questions

FAQs

What is the Sick and Family Leave Tax Credit?

The Sick and Family Leave tax credit for self-employed and 1099 workers is for eligible self-employed individuals or independent contractors.Under the FFCRA, eligible self-employed individuals or independent contractors could claim a refundable tax credit against their income tax liability for up to 100% of the qualified sick and family leave equivalent amounts, subject to certain limitations if they were unable to work or telework due to COVID-19-related reasons.The qualified sick leave equivalent amount was the lesser of either $511 per day or 100% of the average daily self-employment income for each day an individual was unable to work or telework because they were subject to a quarantine or isolation order, had COVID-19 symptoms and were seeking a medical diagnosis, or were caring for someone who was subject to a quarantine or isolation order or who had COVID-19 symptoms.The qualified family leave equivalent amount was the lesser of either $200 per day or 67% of the average daily self-employment income for each day an individual was unable to work or telework because they needed to care for a child whose school or place of care was closed due to COVID-19.To claim the tax credit, eligible self-employed individuals or independent contractors would report the qualified sick and family leave equivalent amounts on their 2019, 2020, or 2021 tax returns, depending on when their leave was taken.

What Documentation Do I Need to Provide?

For the most part, all we require is your 2019, 2020 and 2021 tax return including your schedule C and a copy of your driver's license for identification.

What if I already filed my taxes for 2020 & 2021?

We will need to file an amendment on your tax return. We do this all the time. All we require from you is a copy of your 2019, 2020 and 2021 tax returns and a copy of your drivers license and we’ll handle the rest.

Does This Require Filling Out Lots of Paperwork?

Not at all. Our website has an agreement letter that you must read, sign, and date. You will also need to upload a copy of your 2019, 2020, and 2021 tax returns and a copy of your driver’s license. That’s it.We make the process as easy and stress-free as we can for you. Once we have your tax returns, we’ll take over and get everything filed for you.

What is the Sick and Family Leave Tax Credit?

The Sick and Family Leave tax credit for self-employed and 1099 workers is for eligible self-employed individuals or independent contractors. Under the FFCRA, eligible self-employed individuals or independent contractors could claim a refundable tax credit against their income tax liability for up to 100% of the qualified sick and family leave equivalent amounts, subject to certain limitations if they were unable to work or telework due to COVID-19-related reasons. The qualified sick leave equivalent amount was the lesser of either $511 per day or 100% of the average daily self-employment income for each day an individual was unable to work or telework because they were subject to a quarantine or isolation order, had COVID-19 symptoms and were seeking a medical diagnosis, or were caring for someone who was subject to a quarantine or isolation order or who had COVID-19 symptoms. The qualified family leave equivalent amount was the lesser of either $200 per day or 67% of the average daily self-employment income for each day an individual was unable to work or telework because they needed to care for a child whose school or place of care was closed due to COVID-19. To claim the tax credit, eligible self-employed individuals or independent contractors would report the qualified sick and family leave equivalent amounts on their 2019, 2020, or 2021 tax returns, depending on when their leave was taken.

What Documentation Do I Need to Provide?

For the most part, all we require is your 2019, 2020 and 2021 tax return including your schedule C and a copy of your driver's license for identification.

What if I already filed my taxes for 2020 & 2021?

We will need to file an amendment on your tax return. We do this all the time. All we require from you is a copy of your 2019, 2020 and 2021 tax returns and a copy of your drivers license and we’ll handle the rest.

Does This Require Filling Out Lots of Paperwork?

Not at all. Our website has an agreement letter that you must read, sign, and date. You will also need to upload a copy of your 2019, 2020, and 2021 tax returns and a copy of your driver’s license. That’s it. We make the process as easy and stress-free as we can for you. Once we have your tax returns, we’ll take over and get everything filed for you.

Do I Have to be Self-Employed?

Correct. This tax credit is for self-employed individuals, small business owners, freelancers, and 1099 contractors ONLY.

How Long Till I Get My Refund?

In as little as 10 days! Once we receive the necessary paperwork from you, we will begin to work on your case and get all the forms filed, etc.

How Do I Know If I Am Eligible?

Did you have COVID or test positive for it? Were you tested for COVID? Did you exhibit symptoms similar to COVID?If you experienced symptoms akin to COVID that prevented you from working, earning, and supporting your family. If you were unable to conduct sales. You might qualify for the SETC. If your child's school or daycare was closed, or if you had to assist a family member with COVID or similar symptoms, or if you were quarantined due to your symptoms. If these circumstances hindered your ability to earn during the COVID period, you are probably eligible!

Does the IRS Have Info On SETC?

Yes, read the IRS News Release HERE.

Do I Have to be Self-Employed?

Correct. This tax credit is for self-employed individuals, small business owners, freelancers, and 1099 contractors ONLY.

How Long Till I Get My Refund?

In as little as 10 days! Once we receive the necessary paperwork from you, we will begin to work on your case and get all the forms filed, etc.

How Do I Know If I Am Eligible?

Did you have COVID or test positive for it? Were you tested for COVID? Did you exhibit symptoms similar to COVID?If you experienced symptoms akin to COVID that prevented you from working, earning, and supporting your family. If you were unable to conduct sales. You might qualify for the SETC.If your child's school or daycare was closed, or if you had to assist a family member with COVID or similar symptoms, or if you were quarantined due to your symptoms.If these circumstances hindered your ability to earn during the COVID period, you are probably eligible!

Does the IRS Have Info On SETC?

Yes, read the IRS News Release HERE.

Please be advised that GigWorkers and any GigWorker affiliates such as Funnel Force LLC, etc; are not affiliated with, endorsed by, or in any way officially connected with the Internal Revenue Service (IRS) or any of its subsidiaries or its affiliates. The official IRS website can be found at www.irs.gov. The name “IRS” as well as related names, marks, emblems, and images are registered trademarks of their respective owners. Any references to the IRS on our website are made in the context of providing information or commentary about relevant topics and are for informational purposes only. We do not claim to represent or have any special relationship with the IRS. If you have any questions or concerns related to taxes or the IRS, we recommend contacting the IRS directly.